Washington’s long overdue realignment of terms of trade with the rest of the world has not interfered with expected behavioral relationships in an open and free market economy. The GDP statistics for 2025, released February 20, 2026, show that U.S. imports of goods and services last year increased 2.8 percent, which is well in line […]

WORLD ECONOMY GEOPOLITICS

INVESTMENT STRATEGY

Recent Essays

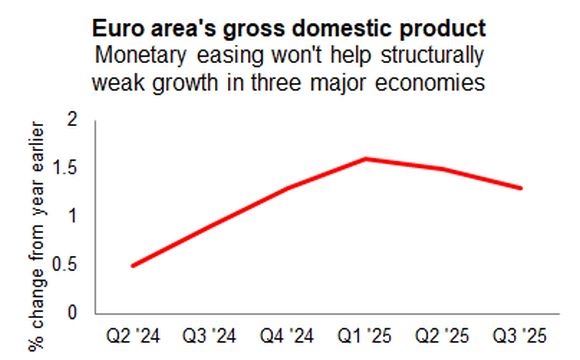

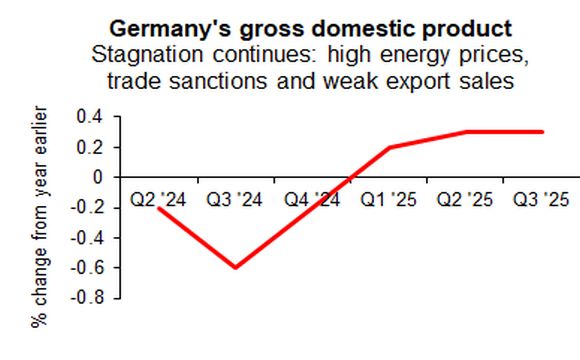

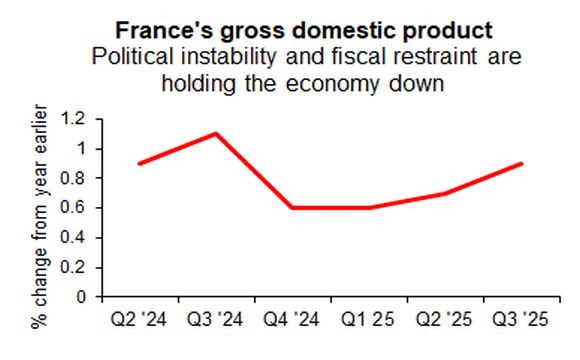

Mainstream media can be forgiven for misunderstanding the reasons of the European monetary union’s sluggish economic growth. But it is quite a different problem when European leaders call for grandiose policy programs while ignoring structural problems that are undermining their epochal project of Europe’s economic and political union. How, for example, can one talk about […]

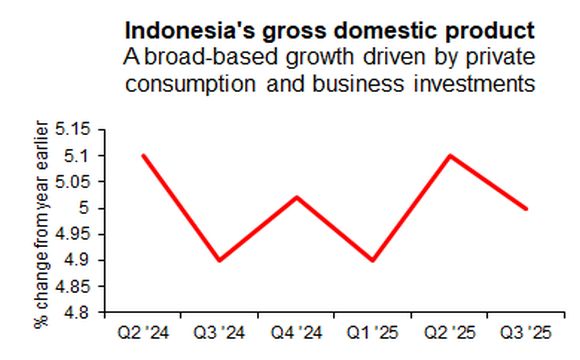

With a rapidly increasing population of 700 million, the economic growth of the trading bloc of eleven Southeast Asian nations (ASEAN) continues to advance at an annual rate of 5 percent. The group’s flexible organizational structure helps to maintain economic, political and social cohesion – without pretensions of becoming a monetary union or a regional […]

Geopolitics have always been the main factor influencing volumes and directions of world trade. Obama administration’s “pivot to Asia” in 2011 was such a geopolitical event that reinforced existing Asian security faultlines. Ostensibly, that move was meant to increase American political and military presence in Asia-Pacific, and to strengthen alliances in one of the fastest […]

The European project of economic and political unification started out with the Treaty of Rome in March 1957 establishing the European Economic Community (EEC) and the European Atomic Energy Community (EAEC or Euratom). There were six founding member countries (Belgium, France, Germany, Italy, Luxembourg and the Netherlands). They wanted to revive their war-ravaged economies through […]

Archives

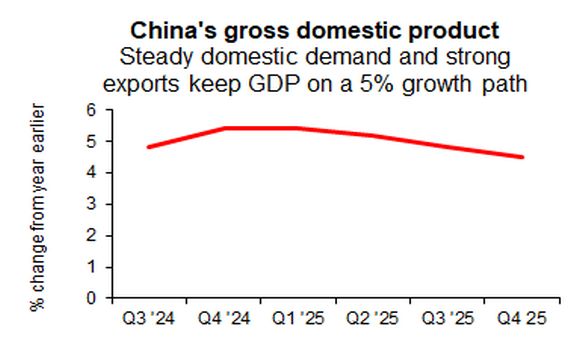

External sector of the Chinese economy -- the sum of exports and imports of its goods and services -- amounts to about 40 percent of the country’s GDP. By that measure, China is an important part of the world trading system, and a country whose economic growth very much depends on its overseas business transactions. […]

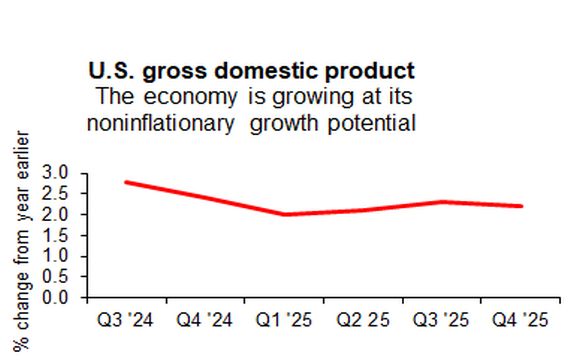

With an increase of 2.1 percent during the first nine months of this year, the U.S. economy is moving along at a pace largely consistent with its physical limits to growth in an environment of somewhat elevated inflation pressures. Over that period, the economy was driven by a 2.8 percent growth of household spending, contributing […]

Put simply, a country running a trade deficit shows that it consumes more goods and services than is supplied by its productive capacities. Conversely, a country with a trade surplus produces more goods and services than is consumed in its domestic markets. The next step is to see what that does to international business transactions, […]

America’s soaring public debt and widening trade deficits have finally forced Washington to review unsustainable economic and security policies with its European allies. Trade with Europe has been a contentious issue ever since the early post-WWII years, when the new international monetary system was established by Bretton Woods agreements (July 1944) with fixed but adjustable […]

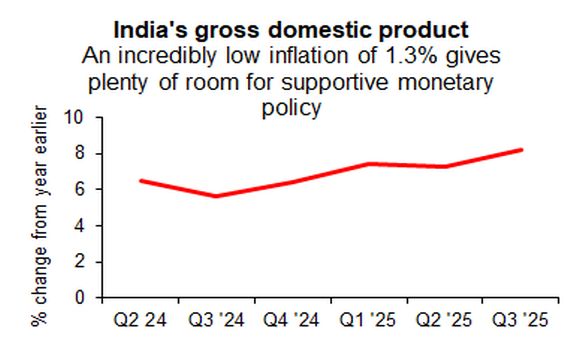

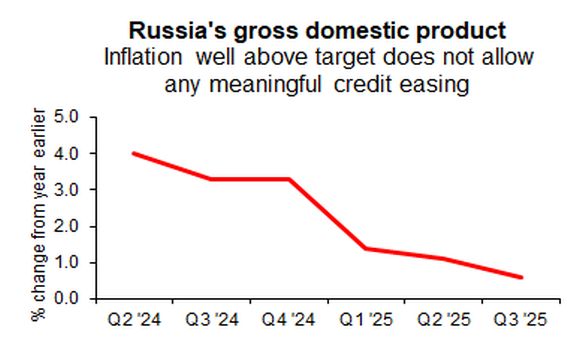

These three countries seem set to tighten up and upgrade the Eurasian and Indo-Pacific wings of a recently enlarged BRICS membership. But to do that, they have to start by broadening the scope of their own relations. India and China have a lot of difficult work to do in that area. The two countries have […]

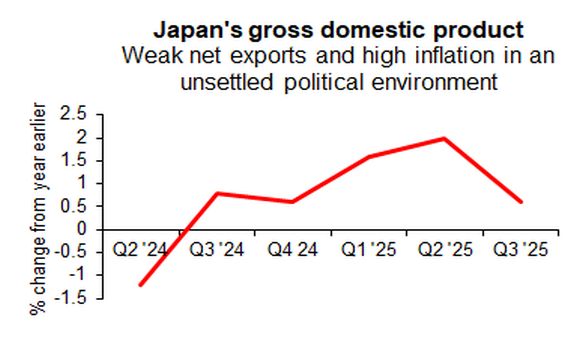

The first estimate of Japan’s third quarter GDP growth shows that trade surpluses are no longer one of the key drivers of economic activity. All the 1.6% growth in the first nine months of this year has been generated by domestic demand – private consumption, investments and government spending. That seems set to continue the […]

Last week set off an impressive demonstration of Asia’s regional leadership dedicated to cooperation, free trade and economic welfare. It all started with the summit of ASEAN (Association of Southeast Asian Nations) in Kuala Lumpur, Malaysia, October 25-28, 2025, where the organization welcomed East Timor as its new member, and where Thailand and Cambodia signed […]

Excessive trade surpluses with the U.S., and large structural trade deficits with China, should be a serious concern for the European Council (a forum of heads of state and government) and its executive commission in Brussels. As things now stand, nothing indicates that those existential questions are about to dislodge the futile bellicose drift of […]

Annual summits of ten Southeast Asian nations (ASEAN) and of the Asia-Pacific Economic Cooperation (APEC) forum will be held later this month to discuss issues of economy, trade and global security. On the margins of these meetings are planned U.S. summits with China and India. Speculations about other U.S. summits in Asia (Russia?, Brazil?) are […]

The economy will be the central issue in the next week’s leadership election of Japan’s governing Liberal Democratic Party (LDP) that has almost continuously held power since 1955. The frontrunner is Sanae Takeichi, Japan’s former internal affairs minister. This is her third attempt to win the LDP’s presidency. And if next week is her third […]