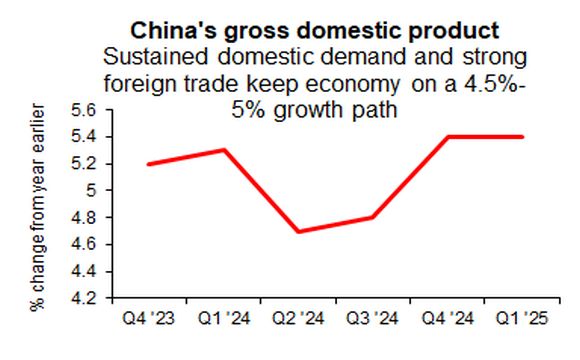

Based on data for the first five months of this year, ASEAN (ten Southeast Asian countries), Japan and South Korea accounted for nearly one-third of China’s foreign trade. Adding to that the remaining nine BRICS members, ten partner countries, and steady trade relations in Central Asia, Africa and Latin America, Beijing’s business with friends and […]

WORLD ECONOMY GEOPOLITICS

INVESTMENT STRATEGY

Recent Essays

The news last week that a trade agreement with China was finalized, and that similar deals would soon be reached with ten major trade partners, drove American stock market valuations to their record high level. That is exactly the opposite of what happened in early February when Washington announced its sweeping trade tariffs, pushing the […]

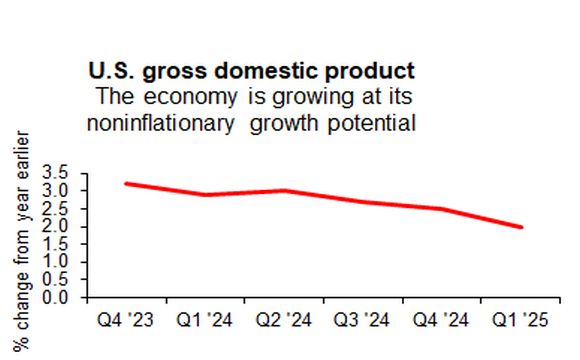

Driven by an exceptionally strong fiscal stimulus and a supportive monetary policy, American domestic demand (consisting of household consumption, residential investments, business investments and government spending) soared 3.5% in the first three months of this year from the same period of 2024. That is the highest rate of growth over the last three years. The […]

Malaysia chaired last week (May 26, 2025), an ASEAN (ten South-East Asian nations) annual summit in Kuala Lumpur. That was followed by a trilateral summit with China and the Gulf Cooperation Council (GCC, consisting of Bahrein, Kuwait, Oman, Qatar, Saudi Arabia and United Arab Emirates). What’s at stake here is a huge new free trade […]

Unlike some other major global powers, China has always treated trade and investments as part of its fundamental development strategy. In that context, political and security considerations played a crucial role in guiding the direction and volume of its business transactions. Beijing has, therefore, patiently and consistently advocated its calls for “win-win cooperation” and “multilateralism,” […]

Archives

Long years of China’s excessive and systematic surpluses on its U.S. trades are part of Washington’s negligence and political miscalculations. But they are also a surprisingly blind spot of Beijing’s economic development strategy. To his credit, President Trump warned about those trade deficits with China during his election rallies in 2015. Unfortunately, his trade officials […]

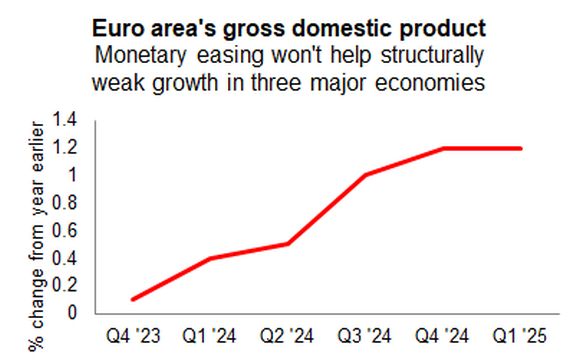

Writing last year about the expected economic policies of a newly elected president, I thought that the Federal Reserve (aka the Fed, U.S. central bank) would have to see the direction of the fiscal policy before any new decisions on interest rates. Things, however, turned out considerably more complicated because a radical change of foreign […]

U.S. trade problems are an old story with deep roots in the international monetary system where America, serving as a banker to the world, allegedly got addicted to “deficits without tears.“ The French pinned that original “sin” to the United Nations Monetary and Financial Conference in Bretton Woods, during July 1- 22, 1944. That’s when […]

More than one-third of China’s $18.3 trillion economy is generated by its foreign trade. Although that is well below the world average of 59% of GDP, China’s exports and imports still present a policy challenge because their dynamics are mainly determined by external demand and price fluctuations on world markets for goods and services. The […]

The state of the U.S. economy will determine (a) the outcome of next year’s midterm elections on November 3, 2026, and (b) President Trump’s ability to govern effectively during the rest of his mandate. Republicans now have a thin majority of 218 seats (with two vacancies currently being filled) in the House of Representatives and […]

Washington is now where it wanted to be at the beginning of President Trump’s first term of office on January 20, 2016. Watching Obama administration’s futile “pivot to Asia” in November 2011 to contain China, and the violent government change in Ukraine in February 2014, followed by the failure of Minsk Agreement of September 2014, […]

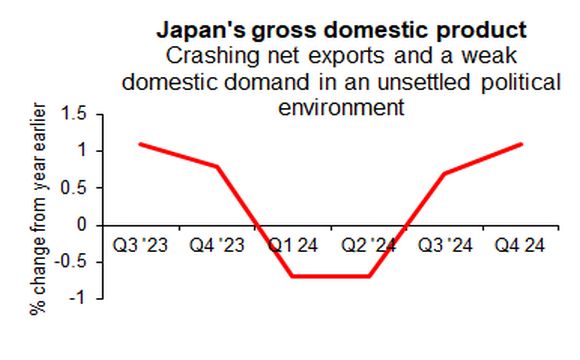

The newly elected Japan’s Prime Minister Shinzo Abe told his first press conference in December 2012 that “China is an indispensable country for the Japanese economy to keep growing. We need to use some wisdom so that political problems will not develop and affect economic issues.” Abe thought he could have a foot in both […]

Thomas “Tip” O’Neill, a Massachusetts Democrat and a speaker of the U.S. House of Representatives from 1977 to 1987, coined a phrase that “all politics is local” to emphasize that voters are primarily interested in issues affecting their areas and communities. And in spite of different party affiliations, Mr. O’Neill had a close political and […]

While the outgoing U.S. government sounds dire warnings that the borrowing limit will be reached next Tuesday (January 21, 2025), and that the country’s financial system could experience major problems, America’s President-elect Donald Trump is reaching out to Chinese and Russian leaders to stop the bloodshed in Europe and Middle East. The road from precarious […]

The exchange of New Year greetings between the Chinese and Russian leaders points to their closer political, economic and security ties. And those were not just the usual well wishes during the festive season. Policy decisions at the highest level of state were anticipated over the last few weeks by statements of the countries’ top […]